Recap of Perpetual Interest Rate Swap

STRIPS is the first derivatives protocol to create the innovative Perpetual Interest Rate Swaps.

A 1 year IRS has a duration of 1 year. By contrast, the duration level of a Perpetual IRS is (Y_i-Y_t)/Y_t. For example, at 10% yield, the duration of a Perpetual IRS that pays $100 annually will equal 1.10/0.1=11 years. However, at an 8% yield, it will be equal to 1.08/0.08=13.5 years. This principle shows that although the maturity is perpetual, the duration will change based on the APY% level. The maturity of the perpetual IRS is infinite, while the duration of the instrument at a 10% yield is 11 years. The cash flow early on in the life of the perpetual IRS, aka the trading PnL dominates the total position PnL. Given the duration and leverage, the actual amplification of a perpetual IRS would be (leverage * duration) of the trading position.

Trader Risk Profile

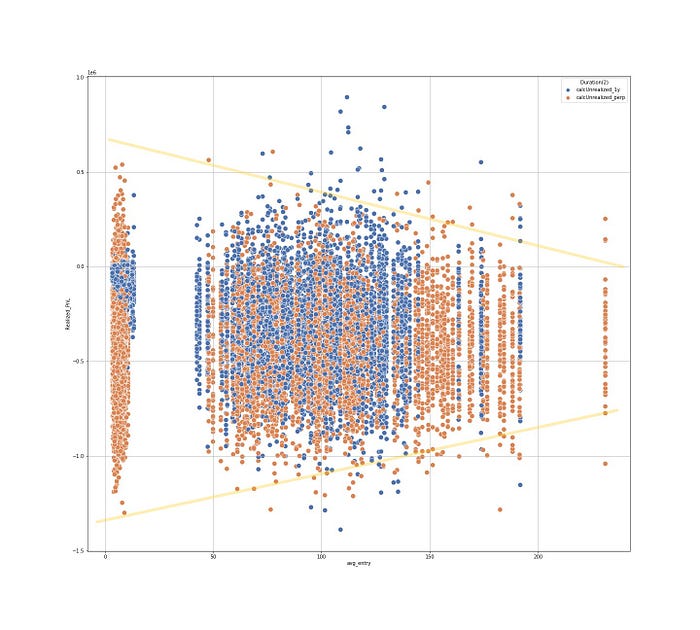

For perpetual IRS, trading PnLvolatility diminishes as APY% increases. For 1yr IRS, the underlying yield level amplifies the PnL: the higher the APY%, the higher the trading pnl volatility.

As highlighted in the orange area, Strips chose perpetual IRS to be our first product because perpetual IRS enables traders to easily earn massive profits, regardless of high or low yields. Perpetual IRS markets will attract more speculators and leveraged yield farmers with higher effective leverage than any other protocol. More diversified flows can lead to more efficient price discovery.

- With lower APY% level, traders can pay less trading fees while enjoying “unlimited” upside and chances of massive gains.

- For high yield, high volatility market, a 1yr-IRS market would achieve similar Realized PnL for traders. Still, traders would have to pay a much higher trading fee and much higher collateral, and hence Strips decides to launch perpetual IRS first: to empower traders with more room of upside.

Next, we will discuss how the amplification effect from leverage × duration would help traders boost their returns.

Traders’ loss is capped at the floor of -100%, while upside can be up to 1,000% powered by perpetual IRS and 10× leverage.

Overall, for perpetual IRS, trading PnL plays the major role in the trader’s total PnL. For short fixed-term IRS, funding PnL plays a bigger role in the trader’s total PnL. In addition, the shorter the fixed term, the higher funding PnL as a portion of total PnL. For low yield low volatility markets (on the right chart): trading PnL will dominate trader’s total PnL, but as time goes, such dominance effect quickly shrinks: the ratio will decrease from 5018× on day 0 to 35× after 20 days. For high yield high volatility markets, trading PnL will dominate trader’s total PnL at a lower level at the beginning. Such dominance effect will also quickly shrink: the ratio will decrease from 445 on day 0 to 17 after 20 days.

Basic Trading Strategies

An efficient and robust IRS market enables many different trading strategies: traders can not only long/short APY, but combine different positions across markets can lead to any risk exposures that traders want. This is why Strips started with perpetual IRS, instead of fixed-coupon bonds. Bonds or yield tokens cater only to a specific use case and limited demands of a small group of people who want low-risk-low-return, which doesn’t fit the typical characteristics of a crypto investor. Instead, we started with the most complicated building block: interest rate swap, which bonds and any other form of cash flows build on.

Below, we will introduce some typical trading strategies that the trader can add to their arsenal. Each strategy may work better under different market environments.

Leveraged Yield Farm

Leverage yield farm used to be a popular strategy because it allows yield farm with higher capital efficiency: to borrow the notional and provide liquidity. However, this strategy faces an obstacle typically due to EXTREMELY HIGH GAS fees. A typical 2.5x leverage yield farm on Alpha Homora costs more than $1500 in Ethereum gas fees. This has alienated a large majority of users.

However, users can still receive leveraged yield farm income on Strips, with minimum cost and lower gas fee on Arbitrum:

- Under normal market conditions: the market fixed rate is relatively low and stable. A user can receive 3% by lending on Compound. Alternatively, the user could make more money with 10x higher returns by going long the IRS on Strips Compound USDC Lending rate market. This strategy is similar to the leverage yield farms provided by other protocols like Alpha Homora and Solfarm.

- Furthermore, this strategy can lead to much higher returns under volatile markets: If the market fixed rate increases from 3% to 20%, the trader can further benefit from the price increase through his trading PnL.

There are significant advantages of conducting leveraged yield farm strategy on STRIPS:

- Fixed borrow cost

- Lower gas fees

- Enjoy leverage up to 10x

- Trading profits if fixed rate goes up

- Choose from DeFi yields, CeFi rates, and more

- Everything settled in USDC

Speculating on Interest Rates

The market fixed rate drives the trader’s trading PnL. When a market interest rate is volatile, it will be profitable for traders to bet on the direction of the market fixed rate regardless of how high or low the APY is. When the market fixed rate goes up, long positions will profit, whereas short positions will profit when the market fixed rate is going down. The floating APY% can diverge from the market fixed rate, which also presents an opportunity for traders. Short positions will have to pay a higher funding rate as the floating APY% goes higher.

- When BTC price increased from $41,763 to $65,158 (+56%), average funding rate increased from 0.0063% to 0.0532% (+844%).

For speculators, the interest rate market is an exciting place to find profitable opportunities. The daily movements in interest rates could be larger than the movements of BTC. If Bitcoin moves up 20%, by contrast the funding rate has been seen to go from 8% to 24%; a 300% move.

Want an example? Check out our medium article explaining what is perpetual interest rate swap!

Next release: we will discuss more advanced trading strategies such as hedge and arbitrage.

Next release: we will discuss more advanced trading strategies such as hedge and arbitrage.

Disclaimer

Any past performance, projection, forecast or simulation of results does not necessarily indicate any investment’s future or likely performance. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Strips Finance.

Strips is currently hiring for several roles. Interested applicants can email their resumes and cover letters to jobs@strips.finance.

To learn more, please visit the project’s website at https://strips.finance/ or follow the project on